What Is The Property Tax In North Dakota . property taxes in north dakota. Let's start by going over each one to understand how they work. Tax rate (mills) taxable values; Compare your rate to the north dakota and u.s. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. north dakota has two different types of property tax. there are three “moving parts” involved in determining your property taxes: county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice.

from itep.org

(ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. property taxes in north dakota. Tax rate (mills) taxable values; Compare your rate to the north dakota and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Let's start by going over each one to understand how they work. The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. there are three “moving parts” involved in determining your property taxes: north dakota has two different types of property tax.

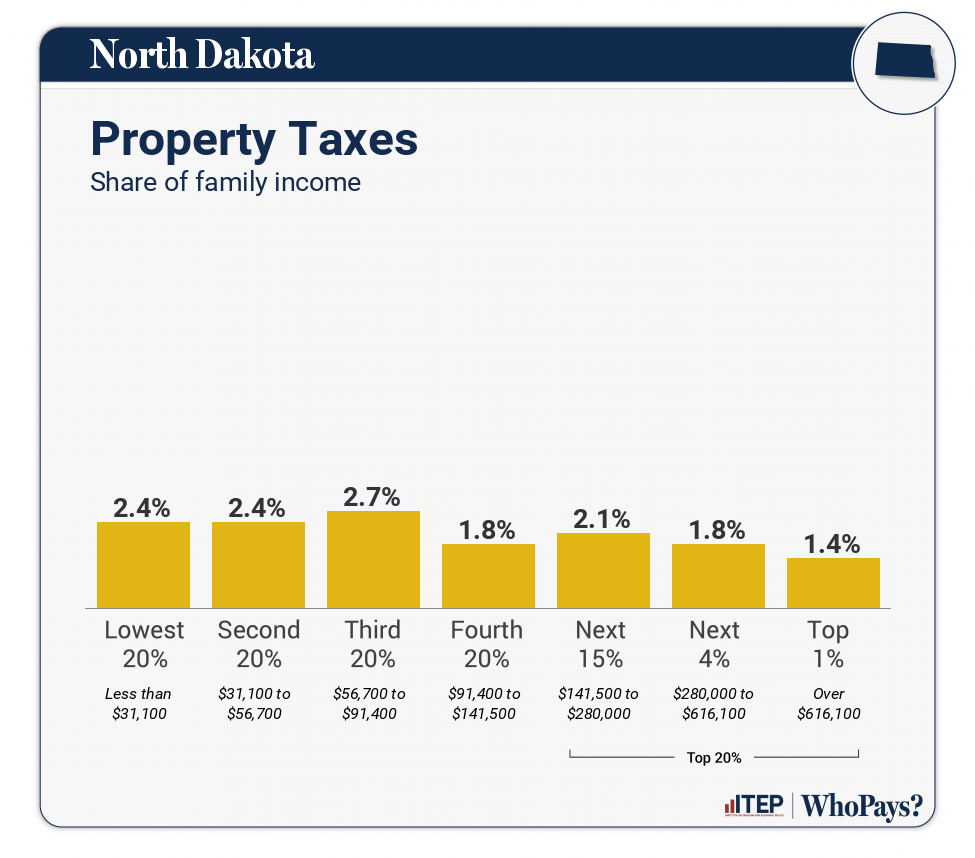

North Dakota Who Pays? 7th Edition ITEP

What Is The Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the north dakota and u.s. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. Let's start by going over each one to understand how they work. property taxes in north dakota. Tax rate (mills) taxable values; there are three “moving parts” involved in determining your property taxes: The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. north dakota has two different types of property tax.

From www.nj.com

North Dakota's nopropertytax dream is infectious What Is The Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. there are three “moving parts” involved in determining your property taxes: Compare your rate to the north dakota and u.s. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. . What Is The Property Tax In North Dakota.

From www.taxcreditsforworkersandfamilies.org

North Dakota State and Local Taxes in 2015 Tax Credits for Workers What Is The Property Tax In North Dakota Let's start by going over each one to understand how they work. property taxes in north dakota. Compare your rate to the north dakota and u.s. Tax rate (mills) taxable values; north dakota has two different types of property tax. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be. What Is The Property Tax In North Dakota.

From www.dailysignal.com

How High Are Property Taxes in Your State? What Is The Property Tax In North Dakota there are three “moving parts” involved in determining your property taxes: Compare your rate to the north dakota and u.s. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. property taxes in north dakota. calculate how much you'll pay in property taxes on your home, given your. What Is The Property Tax In North Dakota.

From dmkrcdqpeco.blob.core.windows.net

What Is The State Tax In North Dakota at Tamika Watkins blog What Is The Property Tax In North Dakota Compare your rate to the north dakota and u.s. Let's start by going over each one to understand how they work. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. . What Is The Property Tax In North Dakota.

From www.steadily.com

North Dakota Property Taxes What Is The Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Let's start by going over each one to understand how they work. Compare your rate to the north dakota and u.s. county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100. What Is The Property Tax In North Dakota.

From www.templateroller.com

Form SFN24733 Download Fillable PDF or Fill Online Application to What Is The Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. there are three “moving parts” involved in determining your property taxes: property taxes in. What Is The Property Tax In North Dakota.

From www.pinterest.com

NorthDakota state and local taxburden has grown 58 between FY 1950 What Is The Property Tax In North Dakota north dakota has two different types of property tax. there are three “moving parts” involved in determining your property taxes: property taxes in north dakota. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. calculate how much you'll pay in property taxes on your home, given. What Is The Property Tax In North Dakota.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment What Is The Property Tax In North Dakota county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. property taxes in north dakota. The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. there are three “moving parts” involved in determining your property. What Is The Property Tax In North Dakota.

From whiteluxuryhomes.com

Property Tax Deductions What You Need to Know! White Luxury Homes What Is The Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. property taxes in north dakota. north dakota has two different types of property tax. Compare your rate to the north dakota and u.s. Tax rate (mills) taxable values; county treasurer provides to the owner of each parcel of. What Is The Property Tax In North Dakota.

From hubpages.com

Which States Have the Lowest Property Taxes? HubPages What Is The Property Tax In North Dakota (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. north dakota has two different types of property tax. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The average effective property tax rate in north dakota is 0.99%, but. What Is The Property Tax In North Dakota.

From www.mprnews.org

Support grows for abolishing property tax in ND MPR News What Is The Property Tax In North Dakota Tax rate (mills) taxable values; there are three “moving parts” involved in determining your property taxes: county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be. What Is The Property Tax In North Dakota.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today What Is The Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Tax rate (mills) taxable values; property taxes in north dakota. Let's start by going over each one to understand how they work. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be. What Is The Property Tax In North Dakota.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics What Is The Property Tax In North Dakota there are three “moving parts” involved in determining your property taxes: Let's start by going over each one to understand how they work. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would. What Is The Property Tax In North Dakota.

From www.templateroller.com

Form SFN28202 Download Fillable PDF or Fill Online Property Tax What Is The Property Tax In North Dakota Tax rate (mills) taxable values; there are three “moving parts” involved in determining your property taxes: Let's start by going over each one to understand how they work. The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. county treasurer provides to the owner of each parcel of taxable property. What Is The Property Tax In North Dakota.

From infotracer.com

North Dakota Property Records Search Owners, Title, Tax and Deeds What Is The Property Tax In North Dakota The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. Let's start by going over each one to understand how they work. north dakota has two different types of property tax. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare. What Is The Property Tax In North Dakota.

From www.endpropertytax.com

End Property Tax in North Dakota End Unfair Property Tax What Is The Property Tax In North Dakota (ap) — north dakota voters will decide this fall whether to eliminate property taxes in what would be a. county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. Compare your rate to the north dakota and u.s. north dakota has two different types. What Is The Property Tax In North Dakota.

From www.tax.nd.gov

About the North Dakota Office of State Tax Commissioner What Is The Property Tax In North Dakota property taxes in north dakota. Let's start by going over each one to understand how they work. Tax rate (mills) taxable values; The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.. What Is The Property Tax In North Dakota.

From ceryjvze.blob.core.windows.net

What Is The State Tax In North Dakota at Roy Bailey blog What Is The Property Tax In North Dakota The average effective property tax rate in north dakota is 0.99%, but this can vary quite a bit. there are three “moving parts” involved in determining your property taxes: county treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice. north dakota has two. What Is The Property Tax In North Dakota.